Get a free notion reading tracker

Creative Financial Literacy Games for Kids That Make Saving Fun

Teaching kids about money doesn’t have to be boring, rigid, or reserved for high school economics. In fact, the earlier kids start understanding concepts like saving, spending, and earning, the better equipped they’ll be for real-world money decisions later in life.

Kids learn best through play. When financial literacy is introduced in a fun, interactive way, it sticks. Games turn abstract ideas like budgeting, delayed gratification, and needs vs. wants into relatable, hands-on experiences. Whether you’re a parent, teacher, or caregiver, incorporating financial games into daily life is one of the smartest ways to raise financially savvy kids.

In this post, we’ll explore creative, kid-approved financial literacy games that make saving fun and build lifelong habits along the way.

1. Savings Jar Challenge (Ages 4–10)

This simple physical game uses clear jars labeled “Spend,” “Save,” and “Give.” Kids earn play or real money for chores, good behavior, or accomplishments — and then choose how to divide it among the jars.

You can create weekly savings goals (“Let’s save $10 this week!”) and use stickers or marbles as visual markers. Let them decide what they’re saving for — a toy, an outing, or even a donation.

This help kids see their money growing, which teaches delayed gratification, goal setting, and visual budgeting.

2. Money Matching Card Game (Ages 5–9)

Use flashcards with coins, bills, and item prices. Kids match the correct combination of money to the value of an item. You can make your own or buy versions like Money Bags or Exact Change.

Add difficulty by introducing change-making or fake sales tax. Create cards that say things like, “Buy a toy for $1.75 — what coins do you need?”

Not only does this fun activity help them learn currency recognition, counting money, but also it helps them with real life math skills.

3. Budget Builder Board Game (Ages 8–13)

Create a printable board game or DIY version on poster board. Players get a fictional monthly income and must make choices about spending: rent, groceries, entertainment, savings. Throw in “life event” cards (surprise bill, gift money, part-time job!) to add realism.

Use dice to move around the board, and keep a running total of each player’s budget. The player with the highest savings at the end wins — but with penalties for overspending!

4. Lemonade Stand Simulator (Ages 6–12)

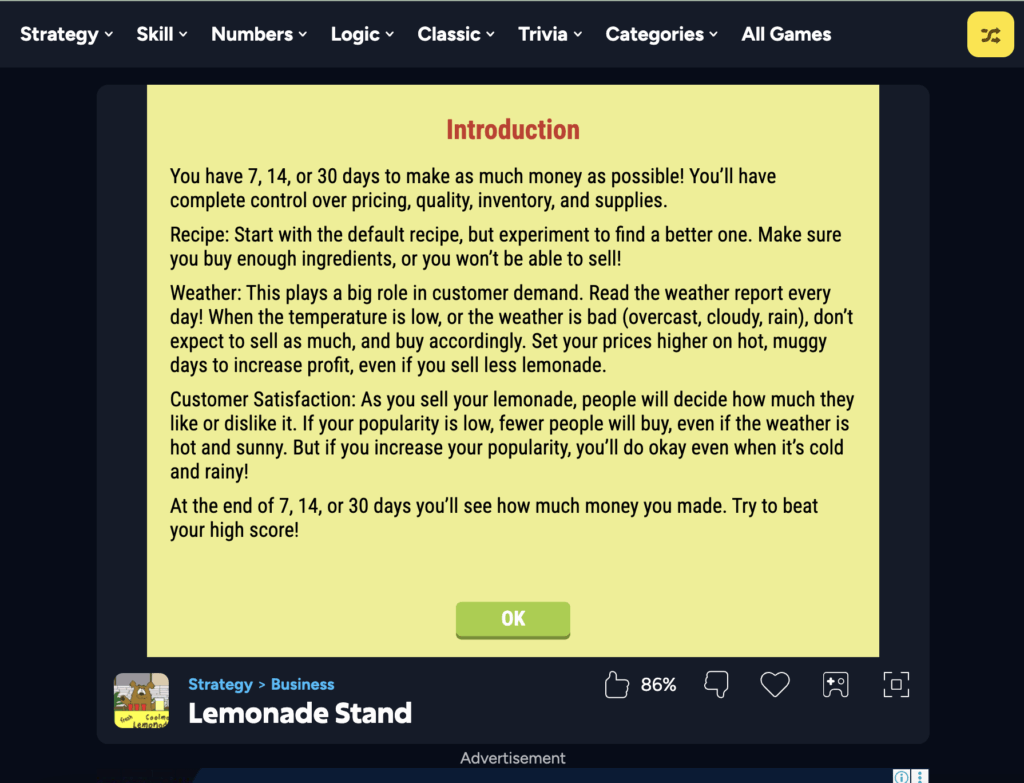

Whether digital or physical, running a pretend lemonade stand helps kids understand profit, expenses, and marketing. Have them “buy” ingredients with play money, set prices, and adjust based on customer feedback.

Online options like the classic Lemonade Stand game simulate market conditions (bad weather = slow sales!).

5. Needs vs. Wants Sorting Game (Ages 4–8)

Print out or draw items like shoes, toys, food, medicine, and video games. Have kids sort them into “needs” and “wants.” Then, give them a limited budget and ask what they would buy first.

Add a story-based version: “You just earned $5. What will you spend it on? What if your pet needs food?”

6. Savings Bingo (Ages 6–11)

Create a bingo card filled with small saving tasks: “Save $1,” “Skip a treat and put $2 in your jar,” “Talk about money with a parent,” or “Set a goal for something you want to buy.”

Each completed square gets marked off. When kids get “bingo,” they earn a prize (or save for one).

7. Shop the House Challenge (Ages 5–10)

Give kids a pretend budget and let them “shop” around the house. They can buy books, snacks, toys, or coupons for family time. Use fake price tags and receipts to make it feel real.

Take it further by assigning prices to chores — so kids can earn and then spend within your homemade economy.

Final Thoughts

When kids learn about money in a playful, hands-on way, will helo them develop financial intuition. These games give them the tools to think critically, plan ahead, and build confidence with money long before they’re old enough to open a bank account.

Financial literacy is a gift that compounds over time. And when saving feels like play, it becomes second nature.